Enterprise reporter, BBC Information

Getty Pictures

Getty PicturesChancellor Rachel Reeves has refused to rule out future tax rises after the UK economic system suffered its worst contraction for a yr and a half in April.

The economic system unexpectedly shrank by 0.3% after taxes elevated for companies, family payments jumped and exports to the US plunged.

The figures come a day after Reeves set out spending plans geared toward boosting progress, with funding will increase for the NHS and defence, however budgets squeezed elsewhere.

Economists warned {that a} failure to extend UK progress would “nearly definitely spark extra tax rises” later this yr for the federal government to steadiness its spending commitments.

Reeves acknowledged the newest financial figures had been “clearly disappointing” and refused to rule out tax rises.

“No chancellor is ready to write one other 4 budgets within the first yr of a authorities, you understand how a lot uncertainty there may be on the planet for the time being,” she informed the BBC.

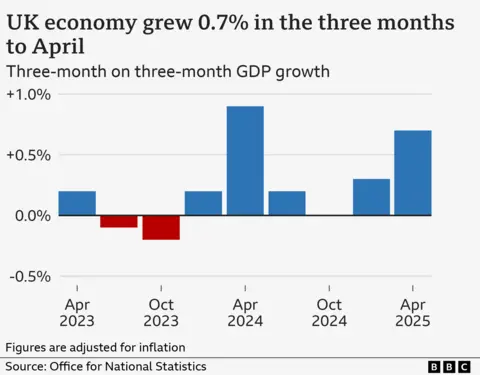

Month-to-month figures on the economic system are risky, and the extra secure three-month determine to April confirmed the economic system grew by 0.7%.

“With spending plans set… any transfer within the incorrect route will nearly definitely spark extra tax rises,” stated Paul Johnson, director of the Institute for Fiscal Research (IFS), an influential suppose tank.

Within the Spending Assessment, Reeves prioritised ploughing billions into long-term initiatives, in a bid to spice up financial progress and enhance dwelling requirements.

However most of the chancellor’s plans comparable to new railway traces and the event of recent UK nuclear plant Sizewell C will take years, with present day-to-day spending budgets being squeezed.

Council tax can also be anticipated to rise to pay for native companies together with policing.

Opposition events stated the chancellor’s earlier resolution to lift employers’ nationwide insurance coverage, which took impact in April, was dragging on progress.

The federal government can also be paying extra to borrow cash.

Lindsay James, funding strategist at British multinational wealth administration firm Quilter, stated the upper value was as a consequence of buyers being cynical over the federal government’s spending plans.

“With the economic system now weakening, we are able to count on to see issues round additional tax rises enhance as we close to the autumn Finances – which is prone to weigh on progress much more.”

Development rising steadily is extensively welcomed, because it normally means individuals are spending extra, further jobs are created, extra tax is paid, and employees get higher pay rises.

However progress within the UK has been sluggish for a few years.

The Workplace for Nationwide Statistics stated a poor month for the companies sector, which incorporates companies starting from outlets and eating places to hairdressers and monetary corporations, had been behind the contraction in April.

Authorized corporations and property corporations additionally “fared badly”, it stated, following a powerful March which noticed many homebuyers speeding to finish purchases to keep away from stamp obligation will increase.

Automobile manufacturing was additionally weak after the introduction of 25% tariffs on UK autos exported to the US. Vehicles are the UK’s largest US export, with one in eight automobiles in-built Britain shipped throughout the Atlantic.

Commerce information confirmed the worth of UK exports decreased by some £2.7bn in April, with items to America alone falling by £2bn, the biggest month-to-month fall on document in exports throughout the Atlantic.

Since April, the federal government has agreed a deal on tariffs with the US and had additionally made commerce agreements with the European Union and India.

Regardless of the tariff pact with the US, a ten% import tax nonetheless applies to most UK items coming into America, with taxes nonetheless larger for metal and automobiles till the deal comes into power.

Grace Sangster and Ollie Vaulkhard

Grace Sangster and Ollie VaulkhardOllie Vaulkhard, director of Vaulkhard group which owns 17 hospitality venues throughout Newcastle upon Tyne, stated the enterprise was beneath strain from the price will increase.

“Every a kind of is manageable – you place all of them right into a pot, finally we have got to cost our prospects extra,” he stated.

Grace Sangster, who’s on an apprenticeship scheme incomes £40,000, stated the federal government ought to do extra to assist first time consumers.

She and her associate Ollie Vass, each 19, purchased their first residence in April, however stated as a result of stamp obligation will increase, the couple needed to pay £3,125, versus zero beforehand.

‘Extra taxes coming’

Shadow chancellor Mel Stride blamed Reeves’s financial decisions for the weak progress.

“The chancellor ought to have taken corrective motion to repair the issues she has triggered. However as a substitute her Spending Assessment has all however confirmed what many feared: extra taxes are coming.”

Liberal Democrat Treasury spokesperson Daisy Cooper stated the figures had been a “get up name for the federal government which has thus far refused to take heed to the small companies struggling to deal with the roles tax”.

In April, employers’ Nationwide Insurance coverage contributions rose to fifteen% from 13.8% with the brink for funds lowered from £9,100 per yr to £5,000.

Companies additionally noticed minimal wages and enterprise charges go up.